The moment has arrived — the moment to take charge. This summer, at Inman Connect Las Vegas, July 30-Aug. 1, 2024, experience the complete reinvention of the most important event in real estate. Join your peers and the industry’s best as we shape the future — together. Learn more.

After slashing $693 million in annual expenses and continuing to invest in technology, loanDepot is positioned to benefit when mortgage rates come down and application volumes rebound, the company said in releasing 2023 earnings Tuesday.

With fourth-quarter revenue up 35 percent from a year ago and expenses down 12 percent, loanDepot was able to trim its Q4 net loss to $60 million, down from $158 million during the final three months of 2022.

For the full year, the Irvine, California-based lender posted a $236 million net loss, also an improvement from the $375 million net loss the company racked up in 2022.

LoanDepot “made substantial progress in 2023, significantly resetting its cost structure and making critical investments in our technology platforms and business processes, which we believe position us to capture the benefits of the eventual rebound in mortgage volumes,” CEO Frank Martell said in a statement.

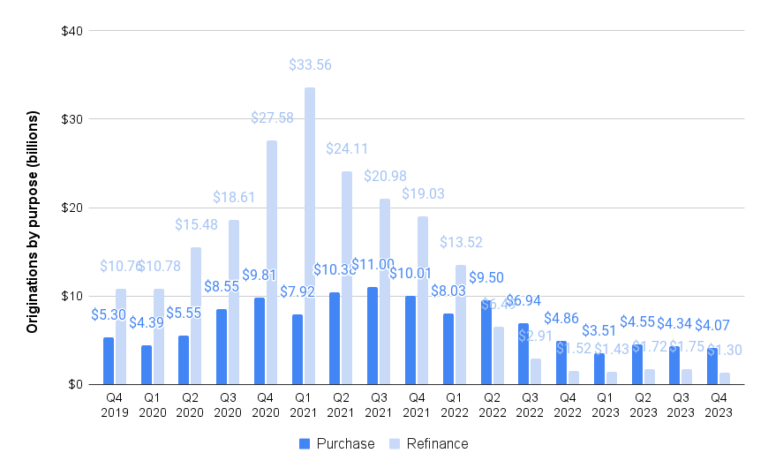

LoanDepot 2023 mortgage originations down 58%

Source: LoanDepot earnings reports.

As mortgage rates soared last year, loanDepot saw 2023 loan origination volume plunge by 58 percent from the year before, to $22.7 billion.

At $5.37 billion, Q4 2023 mortgage origination volume was down less drastically, dropping 16 percent from a year ago.

Purchase loans accounted for 76 percent of originations by dollar volume, up from 19 percent during the first quarter of 2021, as higher rates discouraged homeowners from refinancing.

In reporting Q4 and 2023 earnings, loanDepot said it expects loan originations for the first three months of 2024 will total between $3.5 billion and $5.5 billion — quite a wide range, considering that Q1 will be over in less than 3 weeks.

Company executives had provided a similarly wide range for Q4 mortgage originations in November, saying they expected funded loan volume to total between $4 billion and $6 billion.

Shares in loanDepot, which in the last 12 months have traded for as little as $1.14 and as much as $3.71, dropped 4 percent in after-hours trading Tuesday after closing at $2.54 before earnings were released.

LoanDepot, which began 2022 with 11,300 employees, has shed more than 7,000 workers through layoffs and attrition. The company continued to downsize in the final three months of 2023, reducing the company’s headcount by 282 positions to finish the year with 4,250 employees.

The company is looking to achieve another $120 million in annualized cost reductions this year, and had achieved about 86 percent of that target as of Feb. 29. With a cash balance of $661 million, loanDepot said it “continues to maintain a strong liquidity profile.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.