After roughly four months of improving mortgage rates, the tides have turned and rates are near 7% once again. Rates reached a recent low of 6.08% in late September, before climbing up to 6.9% in the most recent week. Mortgage rates have remained above 6% since September 2022, keeping many would-be sellers “locked in“ and hindering total inventory recovery.

Housing supply has improved over the past year but remains below pre-pandemic levels. Scarce inventory has kept upward pressure on home prices, especially in affordable areas where homes continue to sell at a quick clip and buyers face considerable competition. New-construction inventory has helped fill the gap, and the new-home share of inventory has climbed beyond pre-pandemic levels. As a result, new-home sales climbed annually for the majority of months in the past couple of years.

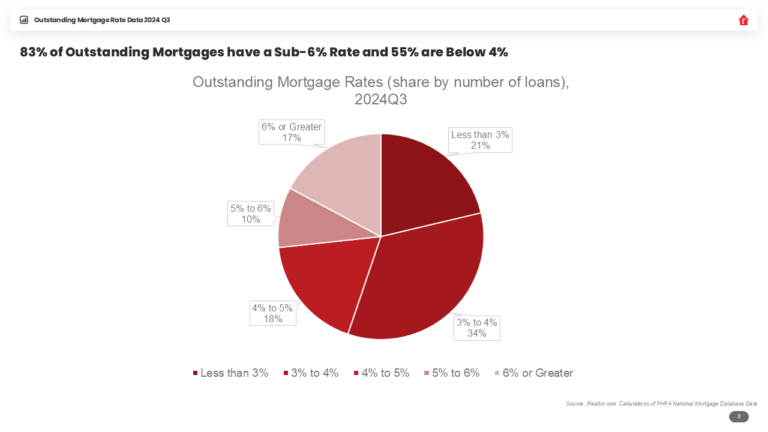

In the third quarter of 2024, 21.3% of outstanding mortgages had an interest rate below 3%. The Freddie Mac fixed rate on a 30-year loan dipped below 3% in July 2020, and generally stayed below the 3% threshold through September 2021. Highlighting how extraordinary these conditions were, this was the only period in the data’s history (since 1971) where rates dropped below this threshold.

| Outstanding Mortgage Rate | Share of Mortgages (2024 Q3) | Cumulative Share |

| < 3% | 21.3% | 21.3% |

| 3% to 4% | 33.9% | 55.2% |

| 4% to 5% | 18.1% | 73.3% |

| 5% to 6% | 9.5% | 82.8% |

| 6% + | 17.2% | 100% |

Roughly a third (33.9%) of outstanding mortgages have an interest rate between 3% and 4%, 18.1% have a rate between 4% and 5%, 9.5% have a rate between 5% and 6%, and 17.2% have a rate of 6% or greater.

Altogether, this means that more than half of outstanding mortgages have a rate of 4% or lower, and roughly three-quarters have a rate of 5% or lower. Looking at the year ahead, we expect that by the end of 2025, the share of mortgages below 6% could fall close to 75%. Put differently, we expect the share of mortgage holders with a rate of 6% or higher to increase by roughly 8 percentage points.

The share of homeowners holding a mortgage with a rate of 6% or higher increased nearly 5 percentage points between Q3 2023 and Q3 2024 as buyer activity carried on, despite high rates. Even in today’s high-price, high-rate market, homebuying activity around big life events (kids, marriage, divorce, etc.) keeps the market in motion. Though the lock-in effect continues to affect the market, a recent survey revealed that a sizable 40% of potential buyers would find a home purchase feasible if mortgage rates were to drop below 6%, and 32% of buyers would be willing to participate if rates dropped below 5%. Easing inflation and mortgage rates will be key drivers of seller activity, which will relieve some of the price pressure and competition felt in today’s under-supplied market.