Redfin economists say this is likely to be the slowest sales year since the Great Recession as persistently high mortgage rates and low inventory spook buyers.

This year is likely to end with roughly 4.1 million existing home sales nationwide, the fewest since the housing bubble burst in 2008 after the subprime mortgage crisis.

What Redfin economists say: “Buyers have been in a bind all year,” said Chen Zhao, Redfin’s economic research lead. “High mortgage rates and still-high prices are making it harder than ever to afford a home, shutting many young people out of homeownership and causing homeowners to reevaluate whether 2023 is the right time to move. Mortgage rates are staying high longer than anticipated, keeping away everyone except those who need to move and pushing our sales projection for the year down to a 15-year low. The last time home sales were this low was during the Great Recession. At that time, tough economic conditions and slow demand pushed home prices down 30% year over year in some parts of the country, creating an opportunity for first-timers to snatch up starter homes–but this time, there’s no deal to be had.”

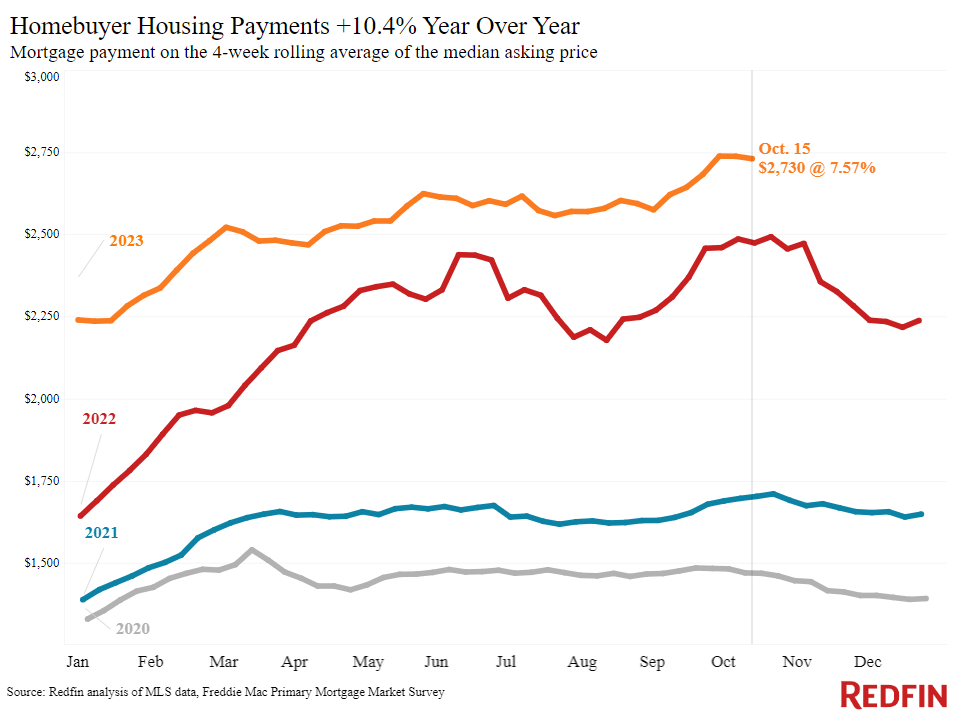

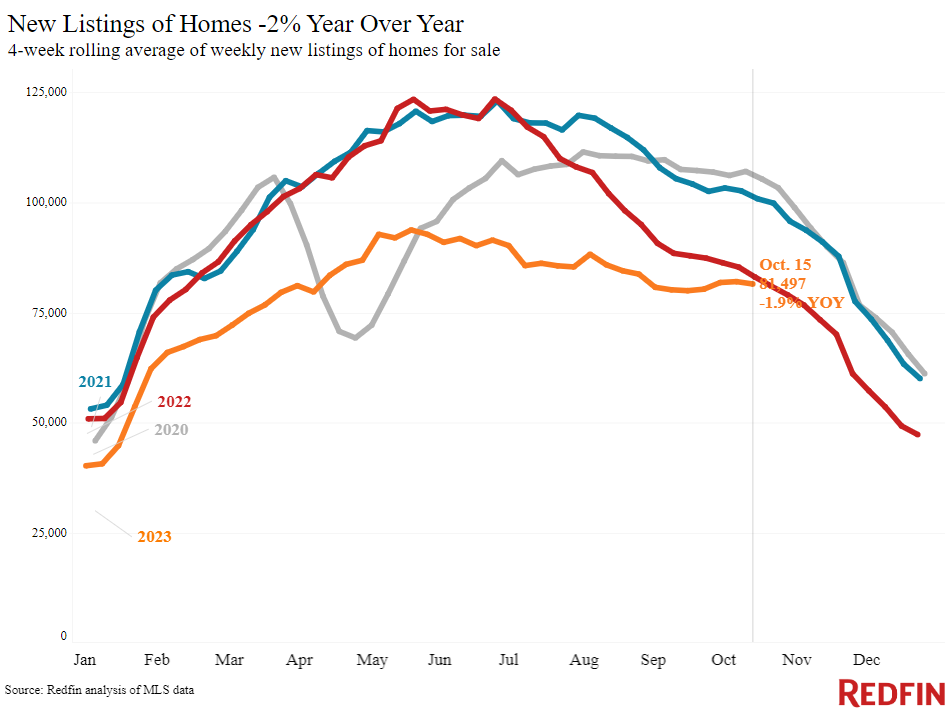

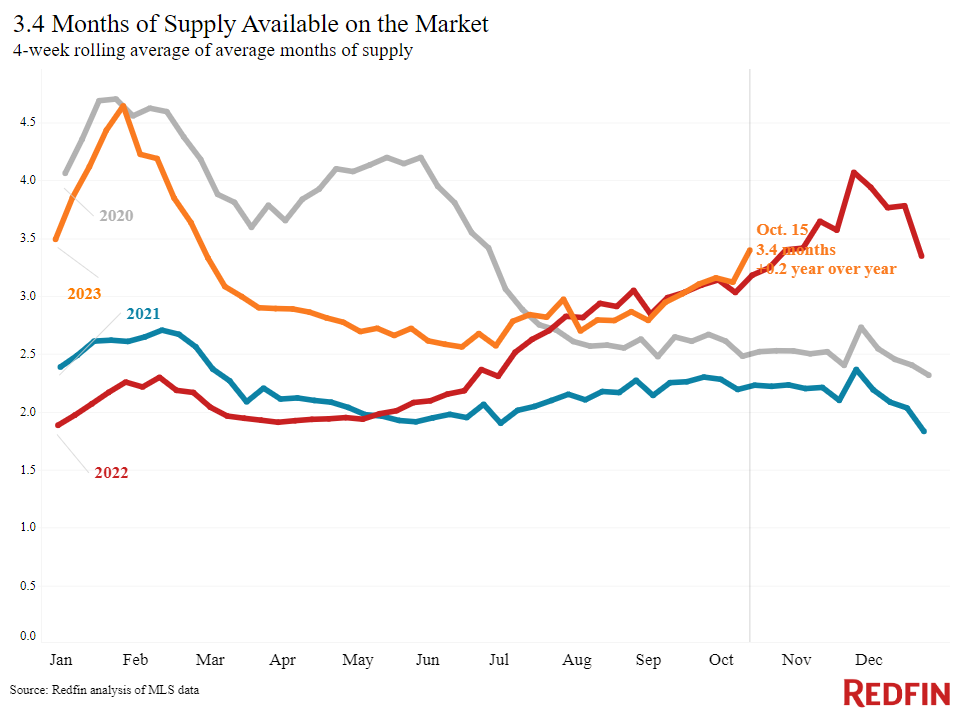

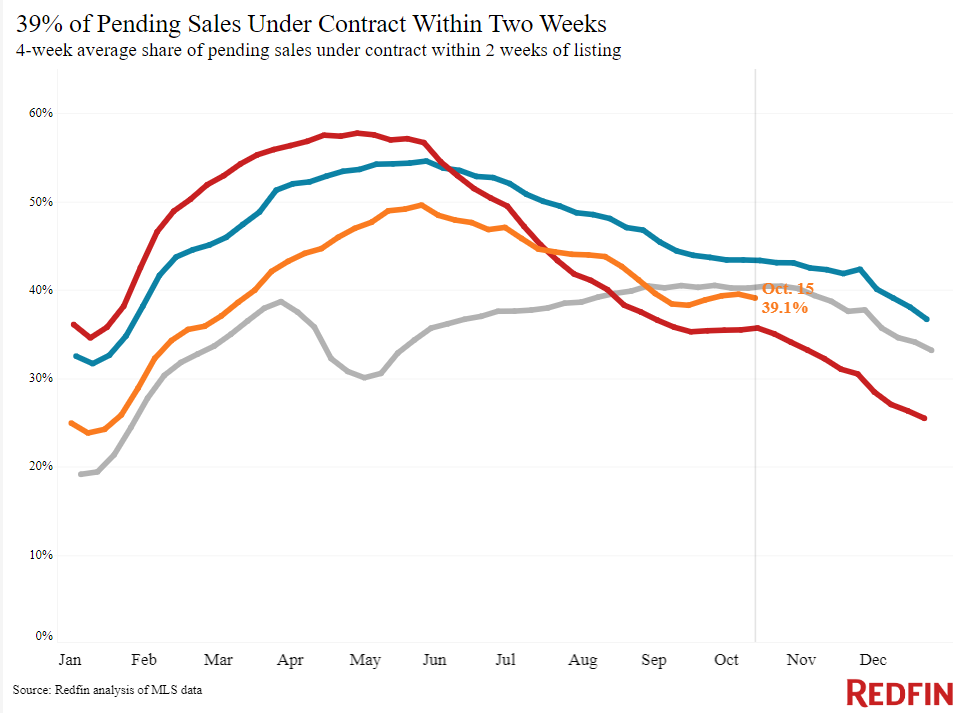

What the numbers say: The average daily mortgage rate hit 8% this week, its highest level in 23 years. Rising rates have pushed buyers to the sidelines, with mortgage applications dropping to their lowest level since 1995 and Redfin’s Homebuyer Demand Index–a measure of tours and other early-stage demand indicators–at its lowest level in a year. Pending U.S. home sales fell 8% year over year during the four weeks ending October 15; that’s the smallest decline in a year and a half, but that’s mostly because sales plummeted at this time in 2022. Low inventory is another factor dampening sales: There are 14% fewer homes for sale than a year ago as homeowners stay put to hold onto relatively low rates. But new listings have ticked up slightly this fall, giving buyers a small reprieve.

What real estate agents say: Redfin agents recommend that buyers who are frustrated by low inventory and high housing costs consider new construction. Sales of newly built homes are holding up better than existing-home sales, largely because builders–unlike regular homeowners–aren’t locked in by low rates, and they’re often more motivated than homeowners to close a deal. Sales of U.S. new-construction homes increased 1.5% year over year in September as prices dropped about 4%, according to Redfin’s data.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 8% (Oct. 18) | Highest level in 23 years | Up from 7.1% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 7.57% (week ending Oct. 12) | Highest level in 23 years | Up from 6.9% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Down 6% from a week earlier (as of week ending Oct. 13) | Down 21% | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Down 6% from a month earlier (as of the week ending Oct. 15) to its lowest level in nearly a year | Down 6% | Redfin Homebuyer Demand Index, a measure of requests for tours and other homebuying services from Redfin agents | |

| Google searches for “home for sale” | Down 23% from a month earlier (as of Oct. 14) | Down 22% | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending October 15, 2023 Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. | |||

| Four weeks ending October 15, 2023 | Year-over-year change | Notes | |

| Median sale price | $369,250 | 2.5% | Prices are up partly because elevated mortgage rates were hampering prices during this time last year |

| Median asking price | $385,048 | 5% | Biggest increase in a year |

| Median monthly mortgage payment | $2,730 at a 7.57% mortgage rate | 10% | Just $8 shy of the all-time high set two weeks earlier |

| Pending sales | 72,183 | -8.4% | Smallest decline since May 2022, partly because pending sales fell rapidly at this time in 2022 |

| New listings | 81,497 | -1.9% | Smallest decline since July 2022 |

| Active listings | 829,629 | -13.6% | |

| Months of supply | 3.4 months | +0.2 pts. | Highest level since February. 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

| Share of homes off market in two weeks | 39.1% | Up from 36% | |

| Median days on market | 32 | -3 days | |

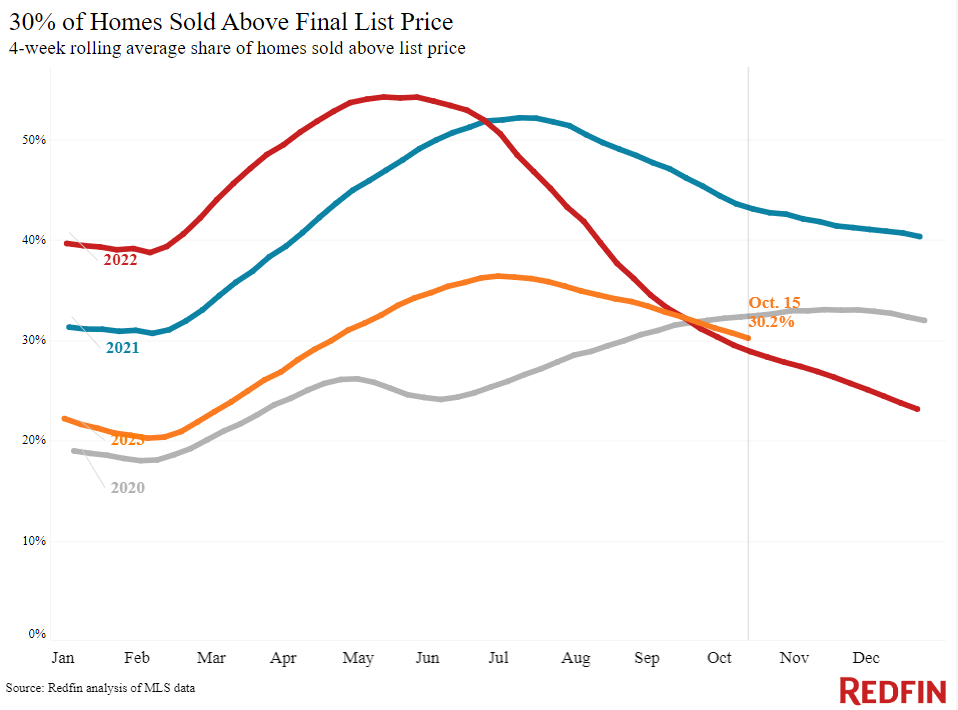

| Share of homes sold above list price | 30.2% | Up from 29% | |

| Share of homes with a price drop | 6.7% | Unchanged | |

| Average sale-to-list price ratio | 99.2% | +0.3 pts. | |

| Metro-level highlights: Four weeks ending October 15, 2023 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. | |||

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases | Notes | |

| Median sale price | Anaheim, CA (17.4%) West Palm Beach, FL (12.7%) New Brunswick, NJ (11.4%) San Jose, CA (10.6%) Newark, NJ (10.6%) | Austin, TX (-4.1%) San Antonio, TX (-2.9%) Houston, TX (-2.3%) New York, NY (-1.2%) Jacksonville, FL (-1.1%) | Declined in 9 metros (in 4 of those metros, the decline was smaller that 1%) |

| Pending sales | Orlando, FL (9.7%) West Palm Beach, FL (9.5%) Las Vegas, NV (4%) Jacksonville, FL (3.3%) Milwaukee, WI (2.9%) | Portland, OR (-25.2%) Sacramento, CA (-20.6%) Houston, TX (-18.3%) Virginia Beach, VA (-18%) Newark, NJ (-17.7%) | Declined in all but 9 metros |

| New listings | Orlando, FL (19.9%) Miami, FL (15.3%) West Palm Beach, FL (13.4%) Fort Lauderdale, FL (10.8%) Jacksonville, FL (9.7%) | Atlanta (-27.3%) Houston (-22.4%) Nassau County, NY (-15.7%) Portland, OR (-14.6%) Columbus, OH (-14.4%) | Increased in 12 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.