Certain cities across the United States are emerging as economic powerhouses, creating ideal conditions for real estate investors.

I’ve published two previous articles on cities with growing tech hubs and high income increases, both of which are highly correlated with price appreciation. Just take a look at the relationship between income and price growth for the top 100 metropolitan areas:

Now, for the third installment in this series, I’ve decided to filter and rank each city’s economy as a whole, under the assumption that the stronger a city’s economy is, the more likely wages will rise, and with them, real estate prices.

I’ve analyzed the data, crunched the numbers, and identified 13 cities with the strongest economies that should be ripe with investment opportunities. Read on to discover where you should be looking next to maximize your returns in 2024.

How I Calculated the Top 13 Cities

First, I downloaded employment and wage data from the Bureau of Labor Statistics (BLS). I also included population data from the U.S. Census Bureau. Finally, I retrieved GDP-per-MSA data from the Bureau of Economic Analysis (BEA).

Next, I calculated one- and five-year growth for population, total employment, and wages for each market. I also used the population data to help create GDP-per-capita data for each city.

Then, I filtered out all cities that had population, employment, or wage decline over the past year. The most robust economies shouldn’t be declining in any of these metrics.

I also only kept metros where the five-year wage and employment growth were greater than the national median (in addition to higher-than-median GDP per capita). I thought this was a good gauge of general economic growth.

Finally, I wanted to rank the remaining metros by job growth. So I created a “relevant employment growth” index that ranked five-year percentage employment growth while still keeping size into account (a 10% increase for a city with 1 million jobs is more impressive than a 10% increase for a city with only 50,000 jobs, but including only absolute growth into an index has its own problems).

Note: Because I used some college-level data science to create the relevant employment growth index, I’ll spare you the details. But feel free to comment if you’d like me to explain how I derived it.

After filtering, I was left with 13 U.S. cities with the best economic metrics, ranked by relevant employment growth. If you don’t see your favorite metro in the list, it’s likely because it either had less-than-stellar employment growth or had an income decline over the past year. Many metros did.

The Results

Now, let’s jump into the results, going from the least relative employment growth to the highest.

13. Allentown-Bethlehem-Easton, PA-NJ

The Allentown, Pennsylvania MSA has undergone a renaissance in the past few decades, from a failing steel manufacturing town in the 1980s to a growing hub for established businesses and startups alike. Allentown’s economy is currently supported by distribution, financial services, and healthcare jobs and remains in close driving proximity to Philadelphia (about one hour) and New York City (about two hours).

Key economic indicators:

- Average Wage in 2024: $56,910.88

- Five-Year Compound Wage Growth: 4.8%

- Total Employment in 2024: 400,600

- Five-Year Compound Employment Growth: 1.19%

- Unemployment Rate in 2024: 4.1%

- GDP Per Capita as of 2022*: $53,539.79

*The most current GDP and population numbers are from 2022.

Affordability indicators:

- Median Price in 2024: $336,043.87

- Five-Year Compound Price Growth: 9.26%

- Median Rent in 2024: $1,796.08

- Five-Year Compound Rent Growth: 7.35%

- Rent-Price Ratio: 0.53%

12. Columbia, SC

The Columbia, South Carolina MSA is supported by the University of South Carolina, Fort Jackson, and healthcare and manufacturing companies. It’s also the second-most affordable market on this list (just behind Oklahoma City), with relatively high prices and rent growth.

Key economic indicators:

- Average Wage in 2024: $52,590.72

- Five-Year Compound Wage Growth: 4.47%

- Total Employment in 2024: 434,900

- Five-Year Compound Employment Growth: 1.63%

- Unemployment Rate in 2024: 4.7%

- GDP Per Capita as of 2022: $53,718.41

Affordability indicators:

- Median Price in 2024: $252,535.39

- Five-Year Compound Price Growth: 9.16%

- Median Rent in 2024: $1,563.14

- Five-Year Compound Rent Growth: 7.53%

- Rent-Price Ratio: 0.62%

11. Colorado Springs, CO

The Colorado Springs, Colorado MSA is supported by military, professional services, distribution, healthcare, and tech jobs. I think Colorado Springs is an example of a steady market that continues to show healthy growth.

Key economic indicators:

- Average Wage in 2024: $61,301.24

- Five-Year Compound Wage Growth: 3.92%

- Total Employment in 2024: 336,600

- Five-Year Compound Employment Growth: 2.21%

- Unemployment Rate in 2024: 4.4%

- GDP Per Capita as of 2022: $53,998.04

Affordability indicators:

- Median Price in 2024: $464,485.54

- Five-Year Compound Price Growth: 7.3%

- Median Rent in 2024: $1,904.88

- Five-Year Compound Rent Growth: 6.12%

- Rent-Price Ratio: 0.41%

10. Greenville-Anderson-Greer, SC

The Greenville, South Carolina MSA is supported by distribution, professional services, and manufacturing jobs. It’s seen strong employment growth, particularly in the blue-collar and financial sectors.

Key economic indicators:

- Average Wage in 2024: $58,228.04

- Five-Year Compound Wage Growth: 5.1%

- Total Employment in 2024: 467,200

- Five-Year Compound Employment Growth: 1.61%

- Unemployment Rate in 2024: 4.7%

- GDP Per Capita as of 2022: $50,607.38

Affordability indicators:

- Median Price in 2024: $299,935.17

- Five-Year Compound Price Growth: 9.23%

- Median Rent in 2024: $1,566.16

- Five-Year Compound Rent Growth: 6.54%

- Rent-Price Ratio: 0.52%

9. Cincinnati, OH–KY–IN

The Cincinnati MSA is supported by healthcare, financial services, and logistics jobs. But I think Columbus has the better economy of the two Ohio metros thanks to its higher employment and wage growth. Keep reading past Fayetteville, Arkansas, to see Columbus’ metrics.

Key economic indicators:

- Average Wage in 2024: $57,448.04

- Five-Year Compound Wage Growth: 4.21%

- Total Employment in 2024: 1,166,200

- Five-Year Compound Employment Growth: 0.8%

- Unemployment Rate in 2024: 4.7%

- GDP Per Capita as of 2022: $69,222.47

Affordability indicators:

- Median Price in 2024: $288,937.75

- Five-Year Compound Price Growth: 8.61%

- Median Rent in 2024: $1,546.9

- Five-Year Compound Rent Growth: 7.15%

- Rent-Price Ratio: 0.54%

8. Fayetteville–Springdale–Rogers, AR

The Fayetteville, Arkansas MSA, commonly referred to as Northwest Arkansas, has an economic ecosystem supported by Walmart, Tyson Foods, J.B. Hunt Transport Services, and all the individual vendors that service these companies, comprising a healthy, growing economy. With strong job and wage growth, low unemployment, and appreciating prices, this market remains one of my top picks.

Key economic indicators:

- Average Wage in 2024: $54,845.96

- Five-Year Compound Wage Growth: 6.21%

- Total Employment in 2024: 311,900

- Five-Year Compound Employment Growth: 3.24%

- Unemployment Rate in 2024: 3.0%

- GDP Per Capita as of 2022: $56,074.19

Affordability indicators:

- Median Price in 2024: $342,107.28

- Five-Year Compound Price Growth: 10.86%

- Median Rent in 2024: $1,612.96

- Five-Year Compound Rent Growth: 7.51%

- Rent-Price Ratio: 0.47%

7. Columbus, OH

The Columbus, Ohio, MSA economy is incredibly diverse and supported by government, finance, healthcare, manufacturing, and tech jobs, and has seen strong wage growth in the past few years. If the property taxes were a bit lower, this might’ve been my favorite market. At a state average of 1.59%, I believe there are a few better metros for real estate investors. But if you don’t mind that, this market has excellent fundamentals.

Key economic indicators:

- Average Wage in 2024: $55,651.44

- Five-Year Compound Wage Growth: 4.99%

- Total Employment in 2024: 1,168,600

- Five-Year Compound Employment Growth: 0.9%

- Unemployment Rate in 2024: 4.5%

- GDP Per Capita as of 2022: $66,834.95

Affordability indicators:

- Median Price in 2024: $316,666.35

- Five-Year Compound Price Growth: 8.92%

- Median Rent in 2024: $1,568.42

- Five-Year Compound Rent Growth: 6.3%

- Rent-Price Ratio: 0.5%

6. Oklahoma City, OK

The Oklahoma City MSA has a growing number of professional services, healthcare, and government jobs supporting the economy. However, OKC sits in the heart of Tornado Alley, which drives up home insurance rates. According to Bankrate.com, “the average annual cost of home insurance is $4,846 for a policy with a $300,000 dwelling limit, which is 113% more than the national average cost of $2,285.” I’d prefer not to invest in a city known for its high occurrence of property-damaging weather events.

Key economic indicators:

- Average Wage in 2024: $56,676.88

- Five-Year Compound Wage Growth: 3.92%

- Total Employment in 2024: 706,200

- Five-Year Compound Employment Growth: 1.56%

- Unemployment Rate in 2024: 3.5%

- GDP Per Capita as of 2022: $52,153.23

Affordability indicators:

- Median Price in 2024: $237,117.57

- Five-Year Compound Price Growth: 7.96%

- Median Rent in 2024: $1,365.59

- Five-Year Compound Rent Growth: 5.66%

- Rent-Price Ratio: 0.58%

5. Boise, ID

Boise, Idaho, has seen a large increase in employment over the years. While unlikely to grow at the same rate it did during the pandemic, the city should continue to see healthy job growth for the foreseeable future. This is a solid market for any investor who can afford it.

Key economic indicators:

- Average Wage in 2024: $56,876.56

- Five-Year Compound Wage Growth: 6.74%

- Total Employment in 2024: 408,100

- Five-Year Compound Employment Growth: 3.42%

- Unemployment Rate in 2024: 3.7%

- GDP Per Capita as of 2022: $51,952.8

Affordability indicators:

- Median Price in 2024: $480,564.72

- Five-Year Compound Price Growth: 9.94%

- Median Rent in 2024: $1,835.37

- Five-Year Compound Rent Growth: 7.47%

- Rent-Price Ratio: 0.38%

4. San Antonio–New Braunfels, TX

San Antonio, Texas, offers many military, healthcare, and professional services jobs. The area remains relatively affordable and has solid employment growth. The only thing I don’t prefer is the high property taxes (a state average of 1.68%, even higher than Ohio’s).

Key economic indicators:

- Average Wage in 2024: $53,292.2

- Five-Year Compound Wage Growth: 3.74%

- Total Employment in 2024: 1,178,000

- Five-Year Compound Employment Growth: 1.82%

- Unemployment Rate in 2024: 4.0%

- GDP Per Capita as of 2022: $52,860.79

Affordability indicators:

- Median Price in 2024: $288,944.75

- Five-Year Compound Price Growth: 6.65%

- Median Rent in 2024: $1,505.12

- Five-Year Compound Rent Growth: 4.29%

- Rent-Price Ratio: 0.52%

3. Raleigh-Cary, NC

Raleigh, North Carolina, has seen growth in healthcare, pharmaceutical, and technology employment over the years, and it doesn’t look like it’s stopping anytime soon. STEM growth drives appreciation, and the rising number of STEM jobs will likely have a positive impact on price appreciation throughout the metro area in the coming years. This is currently one of my favorite markets due to its strong fundamentals, and I can’t recommend it enough.

Key economic indicators:

- Average Wage in 2024: $59,586.28

- Five-Year Compound Wage Growth: 3.73%

- Total Employment in 2024: 748,600

- Five-Year Compound Employment Growth: 3.14%

- Unemployment Rate in 2024: 3.8%

- GDP Per Capita as of 2022: $70,178.38

Affordability indicators:

- Median Price in 2024: $447,526.11

- Five-Year Compound Price Growth: 9.35%

- Median Rent in 2024: $1,797.17

- Five-Year Compound Rent Growth: 5.91%

- Rent-Price Ratio: 0.4%

2. Tampa-St. Petersburg-Clearwater, FL

The Tampa, Florida, MSA has experienced steady growth in the healthcare, finance, insurance, and technology sectors. Overall, it’s a good market with solid fundamentals and a diverse economy. However, insurance prices are likely to continue rising, as many properties are at risk from extreme weather events. Personally, I’ll be skipping this market.

Key economic indicators:

- Average Wage in 2024: $57,930.6

- Five-Year Compound Wage Growth: 3.96%

- Total Employment in 2024: 1,548,700

- Five-Year Compound Employment Growth: 2.48%

- Unemployment Rate in 2024: 3.8%

- GDP Per Capita as of 2022: $57,049.28

Affordability indicators:

- Median Price in 2024: $382,195.19

- Five-Year Compound Price Growth: 11.03%

- Median Rent in 2024: $2,125.23

- Five-Year Compound Rent Growth: 8.88%

- Rent-Price Ratio: 0.56%

1. Phoenix–Mesa–Chandler, AZ

Powered by the nation’s largest nuclear facility (Palo Verde Generating Station) and containing the largest public university in the United States (ASU), it should come as no surprise that Phoenix is a booming metropolis. What is surprising is how much the city grew relative to its already-large size. The economy is diversified, ever-growing, and one of the strongest in the country. I also grew up here and have seen its enormous growth firsthand.

But does this growth have a downside? New-build developments may slow down—the Rio Verde Foothills neighborhood outside of Scottsdale had recently experienced a crisis when it lost its water supply (don’t worry, it’s back—just with a much higher utility cost to residents).

Will Phoenix’s growth spur more water supply crises like this? Maybe, maybe not. But it may limit the rate of suburban sprawl, which may drive up prices in existing homes as demand for housing continues. If you can afford it, now may be an ideal time to enter this market.

Key economic indicators:

- Average Wage in 2024: $63,566.88

- Five-Year Compound Wage Growth: 4.41%

- Total Employment in 2024: 2,413,300

- Five-Year Compound Employment Growth: 2.58%

- Unemployment Rate in 2024: 3.9%

- GDP Per Capita as of 2022: $61,450.29

Affordability indicators:

- Median Price in 2024: $459,067.25

- Five-Year Compound Price Growth: 10.16%

- Median Rent in 2024: $1,884.26

- Five-Year Compound Rent Growth: 7.61%

- Rent-Price Ratio: 0.41%

Final Thoughts

There’s no such thing as the perfect economy. However, each of these 13 cities saw wage, job, and population growth (and GDP per capita) greater than the national median over a five-year period, which could make them excellent markets for your next investment.

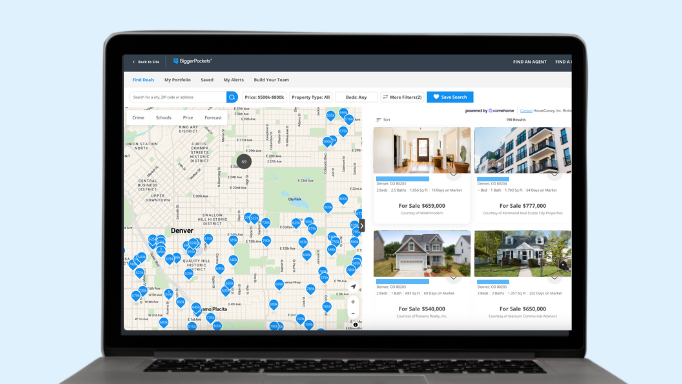

Personally, after I selected my market, I used the BiggerPockets Deal Finder to help me find properties that fit my investment criteria. It might be helpful for you as well.

Find the Hottest Deals of 2024!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.